NJ May Give You A ‘Christmas’ Break If You Owe Taxes: Here’s How

Looking to find a way to pay off your taxes during the holidays? New Jersey says it’s got a way to do it, and save you some money. And it’s a program that could perhaps send another $200 million into the state’s coffers.

The New Jersey Division of Taxation has started a tax-amnesty program to provide individuals and businesses with the opportunity to pay back taxes or file past returns with no penalties and reduced interest. Lawmakers believe the program could raise as much as $200 million in revenues.

The amnesty began Nov. 15 and will run through Jan. 15, 2019.

The Murphy administration went along with the plan after initially criticizing it. Initially, the governor’s office said the state Legislature’s 2019 budget proposal was built on”unsustainable, temporary revenues through a one-shot tax amnesty program” and other ideas.

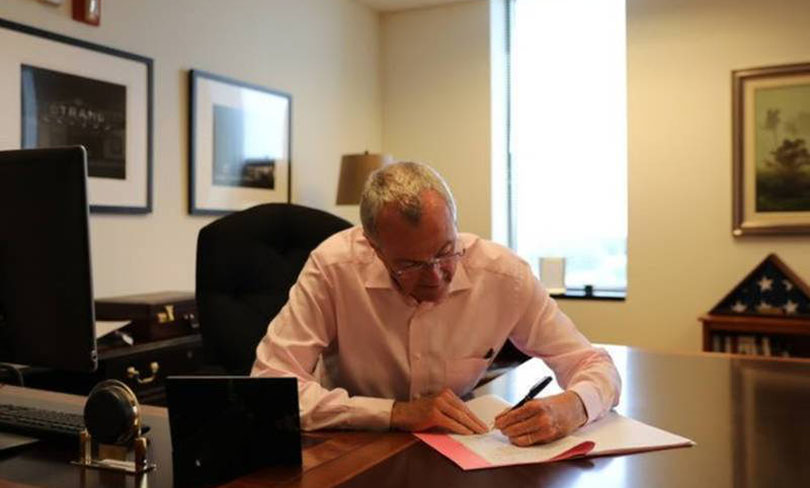

“I’m not going to certify a budget based on gimmicks. We are ending the practice perfected under Chris Christie of making numbers fit a narrative,” Gov. Phil Murphy said during the summer.

But Murphy ultimately signed the budget and the amnesty bill into law in July, saying: “In the spirit of compromise and mutual cooperation, I have agreed to accept this legislative priority.”

The legislation was sponsored by Democratic Assemblyman Robert Karabinchak and Assembly Speaker Craig Coughlin, who said the bill provides relief and a means to satisfy such outstanding debt.

“This bill will help eligible tax payers who, for a variety of reasons, are in arrears with their state taxes,” said Karabinchak, D-Middlesex. “A job loss, health crisis or even a family emergency can change a person’s financial picture.

The program applies to outstanding tax filings or payments that are due on or after Feb. 1, 2009 and prior to Sept. 1, 2017, according to the state Division of Taxation.

Benefits to tax amnesty include waived penalties such as late filing and late payment, and one-half of the balance of interest due as of Nov 1, 2018.

“We are pleased to offer taxpayers a chance at compliance and a fresh start through the New Jersey Tax Amnesty program,” said John Ficara, acting director of the Division of Taxation. “Since Tax Amnesty is offered for a limited time, we’re encouraging taxpayers to take advantage of the program before the Jan. 15 deadline or risk incurring greater penalties.”

Taxpayers who do not take advantage of amnesty before Jan. 15 will incur a 5 percent penalty that cannot be waived or abated. This is in addition to all other penalties, interest and other costs authorized by law, according to the Division of Taxation.

The Division of Taxation recently mailed a letter to all taxpayers who owe on their taxes. In addition, an extensive outreach program has been undertaken to reach as many taxpayers as possible.

For more information, New Jersey taxpayers or their representatives may contact Taxation representatives at 1-800-781-8407 Monday through Thursday from 8 a.m. until 6 p.m. and Friday from 8 a.m. until 5 p.m. or visit TaxAmnesty.nj.gov.